Keeping your assets safe with top-notch property and casualty insurance is essential for managing risks and protecting your financial life. It’s important to know what your high-value homes, special objects, and smart tech need in coverage.1 This article helps you understand high-end asset insurance. It will make you confident in your choices and help you feel secure.

Key Takeaways

- Comprehensive property and casualty insurance solutions are crucial for protecting high-value assets.

- Understanding the unique coverage requirements of luxury homes, valuable possessions, and specialized features is essential.

- Partnering with an insurance advisor specializing in high-net-worth protection can help ensure proper coverage.

- Factors like rebuilding costs, custom features, and smart home technology can significantly impact insurance premiums.

- Specialized policies and endorsements may be necessary to fully safeguard your investments.

Understanding High-Value Home Insurance

If you own a luxury home worth over $750,000, you need special insurance. Standard coverage usually falls short. It might surprise you, but the cost of your home isn’t the only thing to consider. Things like rising building costs are important too. These factors can make your home insurance needs more complex than you think23.

When Do You Need High-Value Home Insurance?

Working with an expert in insuring high-end homes is smart. They can help figure out what it really costs to replace and insure your house properly2. Usually, a home valued at $1.5 million or more requires special coverage3.

Luxury Home Features Requiring High-Value Coverage

Features like special cabinets, exotic floors, and granite counters may not be covered under a basic plan2. A high-value house might include the price to rebuild these parts. It could also cover losses at their full value against all types of risks4.Insurance for high-value homes often provides more coverage. Plus, it usually gives better protection for personal belongings. This can include special coverage for expensive items4.

Protecting Valuable Possessions

Items like antiques, fine art, jewelry, and collectibles can sometimes go beyond what a typical home insurance covers.5 Homeowners with these things should check their policies carefully. They might need more coverage like a special policy for valuable items or an endorsement for personal property.5

Jewelry and Fine Art

Valuable items can include high-end jewelry from places like Harry Winston, Cartier, Tiffany & Co., or Bulgari. Also, fine art, antiques, and collectibles need special insurance.5

Musical Instruments and Collectibles

If you own things like a Steinway piano or a Stradivarius violin, special coverage is smart. This includes valuable music instruments and collectibles. It protects them from theft or damage.5

Furs and Silverware

High-priced fur items and quality tableware could also need more insurance. A usual homeowners policy might not be enough for these.5

High-End Construction Materials and Appliances

Luxury homes have special features or use high-end materials. These add elegance and value.1 But fixing or replacing them costs a lot because of the quality and craftsmanship.1

Custom Cabinetry and Exotic Flooring

Custom cabinetry and exotic hardwood floors are great examples. They make a home more valuable. But if they get damaged, fixing or replacing them is expensive.

Imported Countertops and Specialty Roofing

Luxury homeowners might pick imported marble or granite countertops. They might also choose specialty roofing like slate. These features make a home elegant. But, keeping up with them needs special materials and skills, which could affect insurance costs.1

Professional-Grade Appliances

Installing professional-grade kitchen appliances is another luxury. They cost more to fix or replace. Insurance companies look at this when deciding on premiums.1

Insurance companies carefully check luxury home features. This affects the coverage and premiums homeowners get. To protect their homes fully, owners might need extra insurance.

Smart Home Technology Protection

Advanced smart home technology is growing in popularity. It can make your life easier and your home safer. This includes smart thermostats, intelligent HVAC systems, home security cameras, and voice-controlled assistants. But these technologies can be costly to repair or replace. Insurance providers often see them as valuable and may require more coverage.6

Still, these technologies can boost your home’s value. Your insurance rates might go up due to this. However, features that lower the risk of damage or theft can lower your insurance. They do this by making your home safer.6

Smart home security systems are essential for keeping your home safe. They can deter many burglars just by being there.6 Furthermore, advanced smart home technology like smoke detectors and home monitoring systems can catch problems early. They alert you to things like fires or carbon monoxide. This early alert can save lives.6

Now, many insurance companies offer discounts for using smart home technology. By using these devices, you could lower your insurance premiums. This means you can make your home safer and save money too.

| Smart Home Technology Benefits | Potential Challenges |

|---|---|

|

|

The smart home technology field is always changing. Insurers are now working with top technology companies. They want to offer you the best protection for your home and help lower your insurance rates. By picking the right technologies, you can keep your home safe and potentially save money.7

Property and Casualty Insurance for Outdoor Structures

Outdoor structures in luxury homes, like swimming pools and guesthouses, need special insurance. They can make your home more valuable and appealing. But, they also bring extra risks that require thorough insurance coverage.8

Swimming Pools and Outdoor Kitchens

Swimming pools add to a home’s luxury, but they can be risky. Homeowners might need more liability coverage for potential accidents. This includes injuries that happen in or around the pool.8

Outdoor kitchens also increase a home’s value, offering features like top-notch appliances. However, they are prone to damage and fire. Insurance companies keep this in mind when setting premiums.8

Guesthouses and Carriage Homes

Guesthouses and carriage homes, whether for guests or rent, might need extra coverage. They could bring in more risks that typical insurance doesn’t cover well.8

It’s wise to review your insurance policy. Make sure it’s specific for these structures and their use. This precaution helps in making sure everyone and everything is well-covered.9

Insuring Home Offices and Business Equipment

If you run a business from home or have a lot of office gear in your luxury house, regular home insurance might not be enough. It could leave your business stuff or liability risks not fully covered.10 There are over 33 million small businesses in the U.S. About half are run from home.10 To guard your business equipment and handle liability risks, you might need a separate insurance policy.10

Typically, a standard house insurance covers only up to $2,500 for business items.10 This might not cover the cost of the advanced gear in a luxury home office. It also usually excludes buildings like detached garages used for business.10 So, you might need more coverage.10

A Business Owners Policy (BOP) could be a smart choice. It includes protection for general liability, your business’s property, and if your business has to halt for some reason, often at about $57 a month on average.10 The cost of insuring a home-based business can vary. It depends on your business type, how much coverage you want, your number of employees, the equipment you use, where you are, and your policy limits and deductibles.10

More and more Americans are starting or running businesses from home, a trend that’s growing.11 But, home insurance usually only covers small business equipment up to $2,500.11 Some insurers see a small business as one making under $5,000 yearly.11

There are now special packages for home businesses. These can cover loss of business property, injury claims, documents, and more.11 Make sure your car insurance covers work-related driving. And, if you’re self-employed, health insurance is a must for covering medical bills if you get sick or hurt.11

If you have employees, you might need workers comp. This covers their medical costs and lost wages if they can’t work.11 An umbrella policy can give more liability coverage beyond your regular policy’s limits.11 It’s important for home business owners to work with insurance experts who know what their business needs.11

Home insurance might cost less if you have fire alarms or security.11 Always tell your insurer about changes in your business to make sure you’re covered.11 Your State’s Insurance Department can provide details on local rules.11

| Home Office and Business Insurance Considerations | Key Insights |

|---|---|

| Standard Homeowners Insurance Coverage | Typically covers up to $2,500 of business property. Excludes coverage for “other structures” used for business purposes. |

| Business Owners Policy (BOP) | Combines general liability, commercial property, and business interruption insurance for small businesses. Averages $57 per month. |

| Factors Influencing Home-Based Business Insurance Costs | Type of business, coverage types, number of employees, business equipment, location, coverage limits, and deductibles. |

| Additional Coverages to Consider | Auto insurance for business use, health insurance for self-employed, workers’ compensation for employees, and umbrella liability. |

Working closely with insurance specialists and understanding your home office’s unique needs can protect your luxury home properly. Make sure your home business and equipment are covered right.

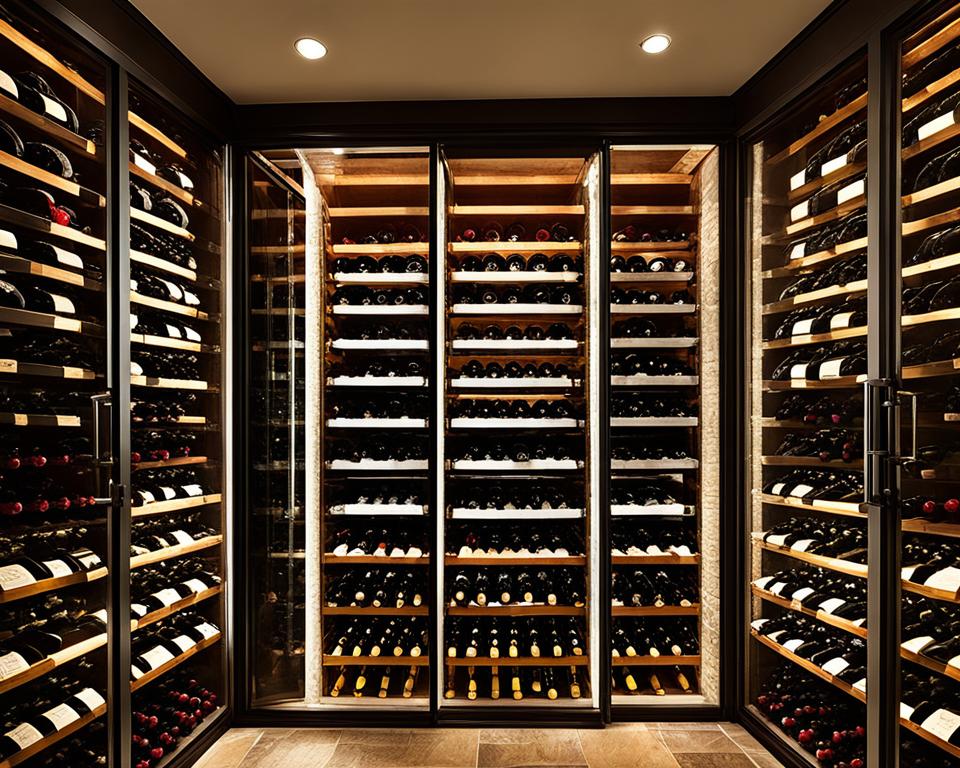

Protecting Wine Cellars and Specialty Collections

Having a wine cellar in your luxury home adds both value and charm. But, it introduces new insurance needs.12 In 2023, the wine industry made $33 billion. Some wines sell for over $1 million a bottle,12 showing why your wine needs special protection. Experts say if your collection is worth over $50,000, get special Collectibles Insurance.12

12 Many choose blanket insurance for their wine. It’s popular because it requires less initial paperwork. Companies like Distinguished offer coverage for many potential risks. This includes damage while moving, breakage, natural disasters, and more. The cost of insuring your wine depends on its value, risk level, and where it is kept, among other things.12

12 Distinguished provides all-inclusive coverage for your wine. This includes not just the wine itself but its containers, storage, and climate control.12 You can buy policies separately from your home insurance. They also automatically cover new purchases for up to 25% of the policy’s total. This policy even covers wine while it’s being transported and can be tailored to your needs with choices on deductibles and payments.12

13 Regular home insurance usually doesn’t cover wine. And, it won’t cover damage once the bottle is opened.13 Special deductibles apply for certain disasters. After opening a wine, you can no longer insure it.13

13 Professional appraisals aren’t always needed for insurance. It’s wise to have a plan for disasters or power cuts, like backup generators. Horton Private Client Group works with top insurers to create custom policies for various needs.13

Home Theater Insurance Considerations

Your luxury home theater with expensive electronic equipment can make your insurance rates go up. If there’s damage from accidents or disasters, fixing or replacing it could be costly.14 Insurers might see your home theater as a risk, needing more coverage to safeguard your entertainment space.

With its detailed custom finishes and top-notch home entertainment systems, insurance companies might keep a close eye on your luxury home theater.14 They could ask for special policies or add-ons to protect your pricey equipment and cover liability risks fully.

Make sure to check your homeowner’s policy for electronic equipment and finishes coverage limits.14 You might need another insurance policy for your home entertainment system or add to your current one. This will make sure your investment is safe.

Talking to an insurance expert who knows about protecting high-value possessions can help. They can guide you through insuring your luxury home theater. This way, you’ll have the right protection for your prized electronic equipment and unique features against surprises.14

Conclusion

Luxury homes offer top-notch comfort and styles. However, their unique aspects need special insurance.15 Knowing how these features affect your insurance is key to protecting your investment.16 Work with an insurance expert who knows about insuring high-value properties. They can guide you through getting the right coverage for peace of mind and full protection.

Your luxury home’s special features are important for your insurance needs. Things like custom cabinetry, exotic floors, and smart home tech matter.15 With a knowledgeable insurance advisor, you can ensure your valuable items are covered. They’ll help safeguard your investment from any unseen dangers.

Don’t risk your luxury home’s safety due to its uniqueness. Get a thorough property and casualty plan suited to you. By doing this, your wealth and lifestyle are protected for the long run. Now, you can live worry-free.

FAQ

When do you need high-value home insurance?

What luxury home features require high-value coverage?

How can you protect your valuable possessions?

How can high-end construction materials and appliances impact insurance coverage?

How can smart home technology affect your insurance needs?

What additional coverage may be needed for outdoor structures?

How can a home-based business impact your insurance needs?

How can a wine cellar or specialty collections affect your insurance coverage?

What factors should you consider for insuring a home theater?

Source Links

- https://www.cbiz.com/insights/articles/article-details/high-value-insurance-protect-your-luxury-home-contents-property-casualty

- https://www.forbes.com/advisor/homeowners-insurance/high-value-home-insurance/

- https://www.usaa.com/insurance/property/homeowners/high-value/

- https://www.bankrate.com/insurance/homeowners-insurance/high-value-home-insurance/

- https://www.usaa.com/inet/wc/insurance-home-valuable-personal-property

- https://www.propertycasualty360.com/2024/03/27/smart-home-devices-may-lure-insureds-to-new-insurers

- https://www.propertycasualty360.com/2024/05/13/the-untapped-potential-of-smart-home-insurance-solutions

- https://nreig.com/is-it-covered-garages-fences-other-structures/

- https://www.sadlersports.com/property-insurance-for-sports-recreation-organizations/

- https://www.forbes.com/advisor/business-insurance/home-based-business-insurance/

- https://www.iii.org/article/insuring-your-home-business

- https://distinguished.com/wine-insurance/

- https://www.thehortongroup.com/personal/high-net-worth/hobby/wine-collection-insurance/

- https://lenoxadvisors.com/Insights/Archives/property-casualty-insurance-7-questions

- https://www.axamansard.com/lifeandliving/life-hacks/why-is-property-casualty-insurance-important

- https://www.financestrategists.com/insurance-broker/property-and-casualty-insurance/